Nykaa is a digitally native consumer technology platform, delivering a content-led, lifestyle retail experience to consumers. They have a diverse portfolio of beauty, personal care and fashion products, including their owned brand products manufactured by Nykaa. Since incorporation in 2012, they have invested both capital and creative energy towards designing a differentiated journey of brand discovery for their consumers.

Category of Shareholders

% of Share Capital

Promoters

Falguni Nayar Family Trust

Promoter Group

Anchit Nayar Family Trust

Adwaita Nayar Family Trust

Promoter Selling Shareholders

Sanjay Nayar Family Trust

Investor Selling Shareholders

TPG Growth IV SF Pte. Ltd

Lighthouse India Fund III, Limited

Yogesh Agencies & Investments Private Limited

Other Selling Shareholders

Harindarpal Singh Banga jointly with Indra Banga

Nykaa has crafted a portfolio of 13 owned brands, including brands such as : Nykaa Cosmetics, Nykaa Naturals, Kay Beauty, Twenty Dresses, Nykd by Nykaa, Pipa Bella.

The company has the highest average order value (AOV) among the leading online beauty and personal care platforms in India (Source: RedSeer and Company DRHP).

In the Financial Year 2021, GMV was ₹40,459.8 million with revenue from operations of ₹24,408.96 million and a 6.61% EBITDA margin (Source: Company DRHP).

To support the expansion plans, the company may have to implement a variety of new and upgraded managerial, operating, technology etc. which in turn may lead to higher costs and oversight by management.

There is risk of increased cost of acquiring new consumers through marketing efforts due to heightened competition for digital traffic in the industry.

Indian Beauty and Personal Care (BPC) Market: Beauty and Personal Care Market in India was sized at Rs. 1,267 billion in 2019, growing at a CAGR of 13% in the last 3 years.

Growth in BPC Spend by Youth: Consumers in the 25-35 years age group are the most active BPC buyers. The customers are also more inclined to buy prestige products. The buying behavior of these consumers is different from that of a traditional Indian shopper.

Increasing BPC Spend from Non-Metro Cities: There has been an increase in aspirational spending on BPC products especially in non-Metro cities enabled by rising disposable income, aided by an increasing female workforce participation, increasing popularity and growing influence of social media, and lifestyle changes.

| Shareholder |

| Retail Individual Investor |

| Non-Institutional Investor |

| Qualified Institutional Buyers |

| Employee |

| Overall |

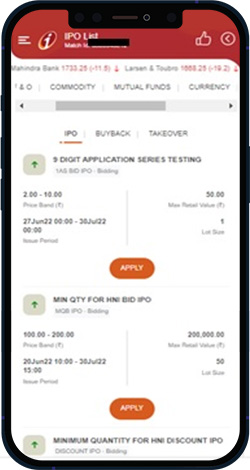

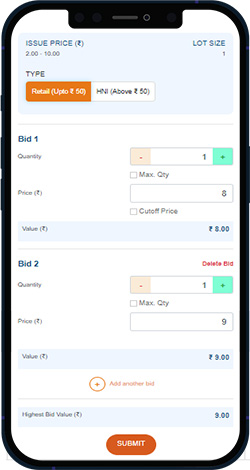

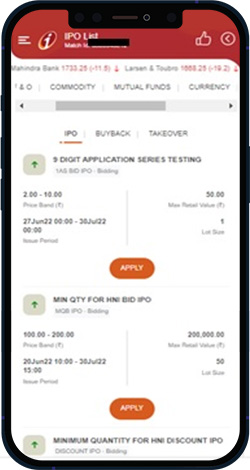

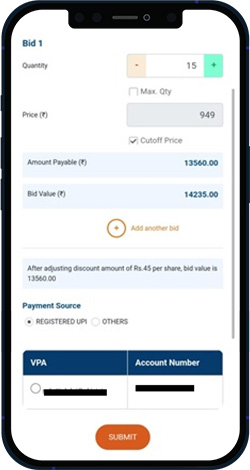

Fill in the quantity of the number of shares you want to buy. To apply at maximum price, check the cut-off price box and amount is auto calculated. If you want to apply at some other price within the price band, then you can enter the price manually by clicking on “Add bid” option.

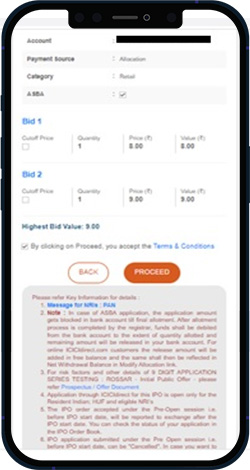

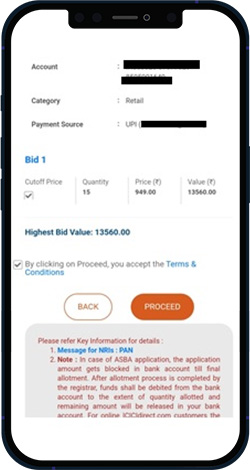

Confirm your request Click on proceed to confirm the order. You can view the placed order under “order book”.

Fill in the quantity of shares. To apply at maximum price, check the cut-off price box and amount is auto calculated. If you want to apply at some other price within the price band, then you can enter the price manually by clicking on “Add bid” option.

Confirm your requestCheck the A/C, UPI details and click on proceed. You will get an UPI link by which payment can be made.

Investments & Liability Products

Award-winning

Disclaimer – I ICICI Securities Ltd. ( I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. I-Sec is acting as a distributor to solicit bond related products. All disputes with respect to the distribution activity, would not have access to Exchange investor redressal forum or Arbitration mechanism. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. Investments in securities market are subject to market risks, read all the related documents carefully before investing. The contents herein mentioned are solely for informational and educational purpose.

Share IPO Link Via:FSN E-commerce Ventures Ltd (Nykaa)

Please enter your details Please enter valid name Please enter valid mobile No. Please enter valid Email Id. Your browser does not support the audio element. Your browser does not support the video element.* Please note Brokerage would not exceed the SEBI prescribed limit.

Customer Care Number

Calculators Account Opening Demat Account Trading Account ICICI Bank Group websites Disclaimer : +The non-broking products / services like Mutual Funds, Insurance, FD/ Bonds, loans, PMS, Tax, Elocker, NPS, IPO, Research, Financial Learning, ESOP funding etc. are not exchange traded products / services and ICICI Securities Ltd. is just acting as a distributor/ referral Agent of such products / services and all disputes with respect to the distribution activity would not have access to Exchange investor redressal or Arbitration mechanism.

Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system w.e.f. September 1, 2020. Update your mobile number & email Id with your stock broker/depository participant and receive OTP directly from depository on your email id and/or mobile number to create pledge. Pay minimum 20% upfront margin of the transaction value to trade in cash market segment. Investors may please refer to the Exchange's Frequently Asked Questions (FAQs) issued vide NSE circular reference NSE/INSP/45191 dated July 31, 2020; BSE Notice no. 20200731-7 dated July 31, 2020 and NSE Circular Reference No. NSE/INSP/45534 dated August 31, 2020; BSE Notice No. 20200831-45 dated August 31, 2020 and other guidelines issued from time to time in this regard. Check your Securities /MF/ Bonds in the consolidated account statement issued by NSDL/CDSL every month.

Disclaimer : ICICI Securities attempts to ensure the highest level of integrity, correctness and authenticity of the content and data updated on the site. However, we may have not reviewed all of the contents and data present on the site and are not responsible or we take no guarantees whatsoever as to its completeness, correctness or accuracy since these details are acquired from third party. In the event that any inaccuracy arises, we will not be liable for any loss or damage that arises from the usage of the content.

Features such as Advanced Charts, Watchlists, F&O Insights @ Fingertips, Payoff Analyzer, Basket Order, Cloud Order, Option Express, e-ATM, Systematic Equity Plan (SEP), i-Track, i-Lens, Price Improvement Order, Flash Trade, Strategy Builder etc., are offered by ICICI Securities. The securities quoted are exemplary and are not recommendatory. Such representations are not indicative of future results. ICICI Securities is not making the offer, holds no warranty & is not representative of the delivery service, suitability, merchantability, availability or quality of the offer and/or products/services under the offer. Any disputes regarding delivery, services, suitability, merchantability, availability or quality of the offer and / or products / services under the offer must be addressed in writing, by the customer directly to respective merchants and ICICI Securities will not entertain any communications in this regard. The information mentioned herein above is only for consumption by the client and such material should not be redistributed.

Name of Investment Adviser as registered with SEBI : ICICI Securities Limited

Type of Registration : Non Individual

Registration number : INA000000094

BASL Membership Certificate no- BASL1136

Validity of registration : Valid till suspended or cancelled by SEBI

Registered office Address : ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400025

Telephone numbers : 022 - 6807 7100

Email id : mfadvisory@icicisecurities.com

Name of Principal Officer : Mr. Anupam Guha

Contact no : 022 - 6807 7100

Email id : mfadvisory@icicisecurities.com

Name of the Compliance officer: Mr. Nirav Shah

Contact number: 022 - 4084 0336

Email id : mfadvisory@icicisecurities.com

Name of grievance redressal Officer:- Mr. Sachin Ubhayakar

Telephone no. of grievance redressal Officer:- 022 - 6807 7400

Email id : mfadvisory@icicisecurities.com

Corresponding SEBI regional / local office address : Securities & Exchange Board of India, Plot No.C4-A, 'G' Block Bandra-Kurla Complex, Bandra (East), Mumbai - 400051, Maharashtra

SEBI Research Analyst Registration Number - INH000000990 Name of the Compliance officer (Research Analyst): Mr. Atul Agrawal Contact number: 022 - 40701000

None of the research recommendations promise or guarantee any assured, minimum or risk free return to the investors.

Disclaimer : Registration granted by SEBI, membership of BASL and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

Attention Investors : Prevent unauthorized transactions in your account. Update your mobile numbers/email IDs with your stock brokers. Receive information of your transactions directly from Exchange on your mobile/email at the end of the day. Issued in the interest of Investors (Ref NSE : Circular No.: NSE/INSP/27346, BSE : Notice 20140822-30.) It has been observed that certain fraudsters have been collecting data from various sources of investors who are trading in Exchanges and sending them bulk messages on the pretext of providing investment tips and luring the investors to invest in bogus entities by promising huge profits. You are advised not to trade on the basis of SMS tips and to take an informed investment decision based on authentic sources. issued in the interest of investor of investor (RefNSE : circular No.: NSE/COMP/42549, BSE:Notice 20191018-7)

ICICI Securities Limited:

Registered Office:

ICICI Venture House,

Appasaheb Marathe Marg,

Prabhadevi, Mumbai - 400 025, India

Tel No: 022 - 6807 7100

Fax: 022 - 6807 7803

For any customer service related queries, assistance or grievances kindly Call us at 1860 123 1122 or Email id: headservicequality@icicidirect.com to Mr. Bhavesh Soni

ICICIdirect.com is a part of ICICI Securities and offers retail trading and investment services.

Member of National Stock Exchange of India Limited (Member code: 07730), BSE Limited (Member code: 103) & Metropolitan Stock Exchange (Member code: 17680),Multi Commodity Exchange of India Limited (Member code: 56250) SEBI Registration number INZ000183631

Name of Compliance Officer (Broking) : Ms. Mamta Shetty E-mail Address : complianceofficer@icicisecurities.com / Tel No: 022-4070 1000

Investments in securities market are subject to market risks, read all the related documents carefully before investing. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. Please note Brokerage would not exceed the SEBI prescribed limit.

Margin Trading is offered as subject to the provisions of SEBI Circular CIR/MRD/DP/54/2017 dated June 13, 2017 and the terms and conditions mentioned in rights and obligations statement issued by I-Sec.

Account would be open after all procedure relating to IPV and client due diligence is completed.

ICICI Securities Ltd. (I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Mumbai - 400025, India, Tel No: 022 - 6807 7100, Fax: 022 - 6807 7803. Composite Corporate Agent License No.CA0113. Insurance is the subject matter of solicitation. ICICI Securities Ltd. does not underwrite the risk or act as an insurer. The advertisement contains only an indication of the cover offered. For more details on risk factors, terms, conditions and exclusions, please read the sales brochure carefully before concluding a sale.

Responsible Disclosure: In case you discover any security bug or vulnerability on our platform or cyber-attacks on our trading platform, please report it to ciso@icicisecurities.com or contact us on 022-40701841 to help us strengthen our cyber security.